Ctrl Alt Elite - 50/30/20 Budget Calculator

Input your monthly after-tax income into this budget calculator to determine your spending.

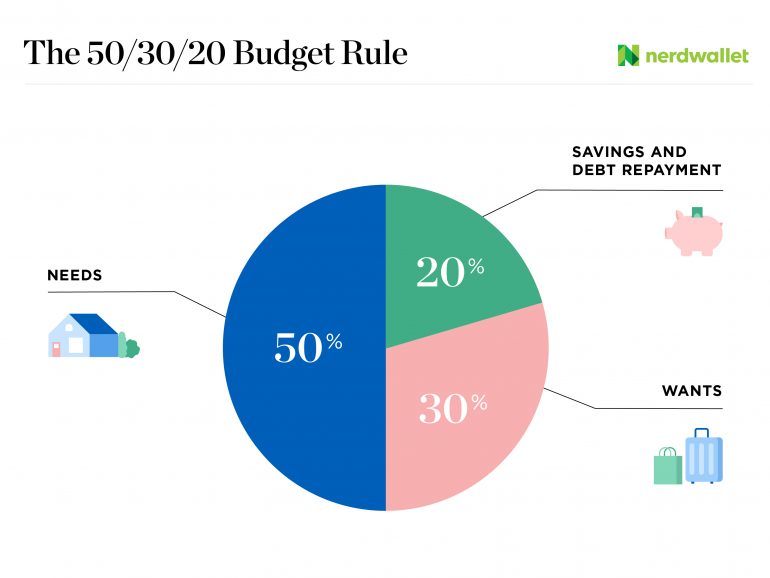

The 50/30/20 Rule

The 50/30/20 rule divides your take-home income into three categories: 50% for needs, 30% for wants and 20% for savings and debt repayment. Here’s how it breaks down:

Monthly after-tax income. This figure is your income after taxes have been deducted and the cost of payroll deductions for health insurance, 401(k) contributions or other automatic savings have been added back in.

50% of your income: needs Necessities are the expenses you can’t avoid. This portion of your budget should cover costs such as:

- Housing

- Food

- Transportation

- Basic Utilities

- Insurance

- Minimum loan payment. Anything beyond the minimum goes into the savings and debt repayment bucket.

- Child care or other expenses that need to be covered so you can work.

30% of your income: wants. Distinguishing between needs and wants isn’t always easy and can vary from one budget to another. Generally, though, wants are the extras that aren’t essential to living and working. They’re often for fun and may include:

- Monthly Subscription

- Travel

- Entertainment

- Meals out

20% of your income: savings and debt. Savings is the amount you sock away to prepare for the

future.

Devote this chunk of your income to paying down existing debt and creating a comfortable financial

cushion

to avoid taking on future debt.

How, exactly, to use this part of your budget depends on your situation, but it will likely include:

- Starting and growing an emergency fund.

- Saving for retirement through a 401(k) and perhaps an individual retirement account.

- Paying off debt, beginning with the toxic, high-interest type.